Strategies to help your business thrive in any economy

As a business owner, the goal of growing your business is always on your mind. While looking for new strategies, you may have discovered the business cycle yet not know how to use it to your advantage.

This post will help answer the questions:

- What is the business cycle in economics?

- How does it affect my business?

- What strategies can I use to take advantage of business cycles in the United States?

Let’s dive in so you can stay ahead of your competitors by working with the business cycle rather than against it.

Understanding the business cycle

The business cycle is known by many terms: economic cycle, growth cycle, recession cycle, trade cycle, and many others.

The U.S. business cycle is the rise and fall of the value of all U.S. goods and services produced and sold on the market during a period of time. This value is our gross domestic product (GDP)—a measure of our financial health.

The global and U.S. economies have their business cycles, and each company has its own business cycle.

The big picture

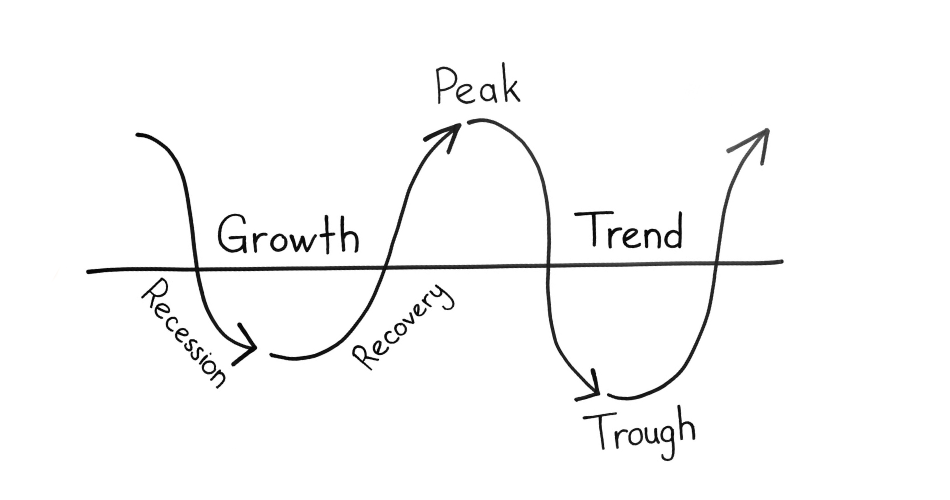

From a high-level (macroeconomic) view, the business cycle describes the repeating natural pattern of expansion, peak, contraction, trough, and recovery that occur in all economies over time, measured by changes in real GDP.

The business cycle illustration below depicts a complete cycle, measured from the start of an expansion to the bottom of the following trough. Historically, expansions have been longer than contractions, resulting in long-term GDP growth in the U.S.

What impacts the economy cycles?

Many factors influence the business cycle, causing the entire economy to fluctuate. These include changes in pricing and demand for products and services, interest rates, production and energy costs, emerging technology, government policies, shifting demographics, natural disasters, and even people’s expectations—their fear or confidence in micro or macroeconomic factors.

How does the business cycle affect my business?

Let’s switch to our everyday (microeconomic) view. While the U.S. business cycle includes data across all industries for all companies contributing to the economy, your company has its own unique business cycle. Most companies experience four business cycle phases: startup, growth and establishment, maturity, and decline or exit.

Understanding where the economy and your company are in their respective business cycles will help you ride the waves by making better business decisions. The strategies you adopt will position your business for steady growth, better stability, and stronger competition, increasing your chances for success.

You’ll be more aware of opportunities and challenges so you can adjust to changes. By considering the economic phase, you’ll make informed decisions about hiring, pricing, investing in your business, and how much to produce.

Strategies to navigate the business cycle

The decisions you make during different phases of the U.S. business cycle depend on where your company is in its business cycle. In general, consider the tactics below during each economic phase:

Expansion

Most people are happy. The economy is growing. Prices increase, but so does employment, so workers can afford higher prices. Consumer spending increases. Inflation is around a comfortable two percent.

Strategies: This is a perfect time to start a new business or expand an existing business. Sales are strong. You can invest in new technology, products, or services; increase research; or purchase new land or buildings. You can raise prices, ramp up production, hire new employees, and even offer higher salaries or better benefits to attract the best workforce.

Peak

The expansion begins to slow, inflation begins to rise, and we’ve reached the top of the expansion phase with GDP at its highest. However, we can’t prove this until the contraction phase sets in.

Strategies: Overconfidence can get a business in trouble. When you see the economy starting to change, such as increasing inflation, lower sales, and higher unemployment, it’s best to prepare for an upcoming downturn by becoming more conservative with the increases made during the expansion phase. Higher inflation and interest rates mean cash will not go as far. Consumers begin to cut back, requiring you to slow production.

Contraction (recession, depression, or both)

What goes up must come down. Many people are unhappy and even more worried. The economy is declining. Prices, employment, spending, and sales all decrease. Recessions come at a point when GDP has declined for two consecutive quarters. Indicators of a depression include a recession lasting at least three years, significantly high unemployment and inflation, declining property sales, increasing credit card defaults, and bankruptcies.

Strategies: This could be the time to contract along with the economy. Decrease your prices as necessary to maintain sales, stop hiring, and possibly lay off employees depending on the severity of the decline. It might be time to reduce production and stop expanding your business. You may need to sell off portions of the business.

On the other hand, if your business is solid, you can use a recession in positive ways by investing in your business to prepare for better times, maintaining liquidity, analyzing cash flow, and driving additional sales.

Trough

Fortunately, the economy has reached the bottom of its contraction phase, but we can’t pinpoint when until recovery sets in. GDP can fluctuate for a number of quarters during this phase, hovering in the low one to 1.5 percent range. Production and employment are at their lowest points.

Strategies: You can think about breathing again, but when? Take some time to assess the damage resulting from the contraction. Decide whether investing is lucrative since prices are lower.

Recovery

We all breathe a sigh of relief. Most indicators are beginning to turn around. GDP returns to about two percent. The economy is ready to start the next expansion phase.

Determine how prepared you are for the next expansion. Adjust your pricing as sales begin to increase, consider the best ways to invest in your business, and increase hiring accordingly.

Take advantage of the business cycle

Understanding and leveraging the business cycle is crucial to your long-term success. By aligning your business strategies to the economic phases, you can effectively navigate prosperous and challenging times. Mastering the art of working with the business cycle rather than against it gives your company a significant competitive advantage.

Stay informed about economic indicators and adapt your strategies as the business cycle progresses. Position yourself to capitalize on opportunities during expansions, weather contractions more resiliently, and emerge stronger when the economy recovers.